Understanding the Mortgage Process for Lenders

The mortgage process is a critical pathway not only for prospective homeowners but also for lenders navigating through a complex landscape of financial regulations and customer needs. For a lender, understanding each stage and its implications can lead to smoother transactions and better customer satisfaction. In this guide, we will delve into the mortgage process for lenders, examining key stages, the importance of pre-approval, and the challenges faced during the application phase.

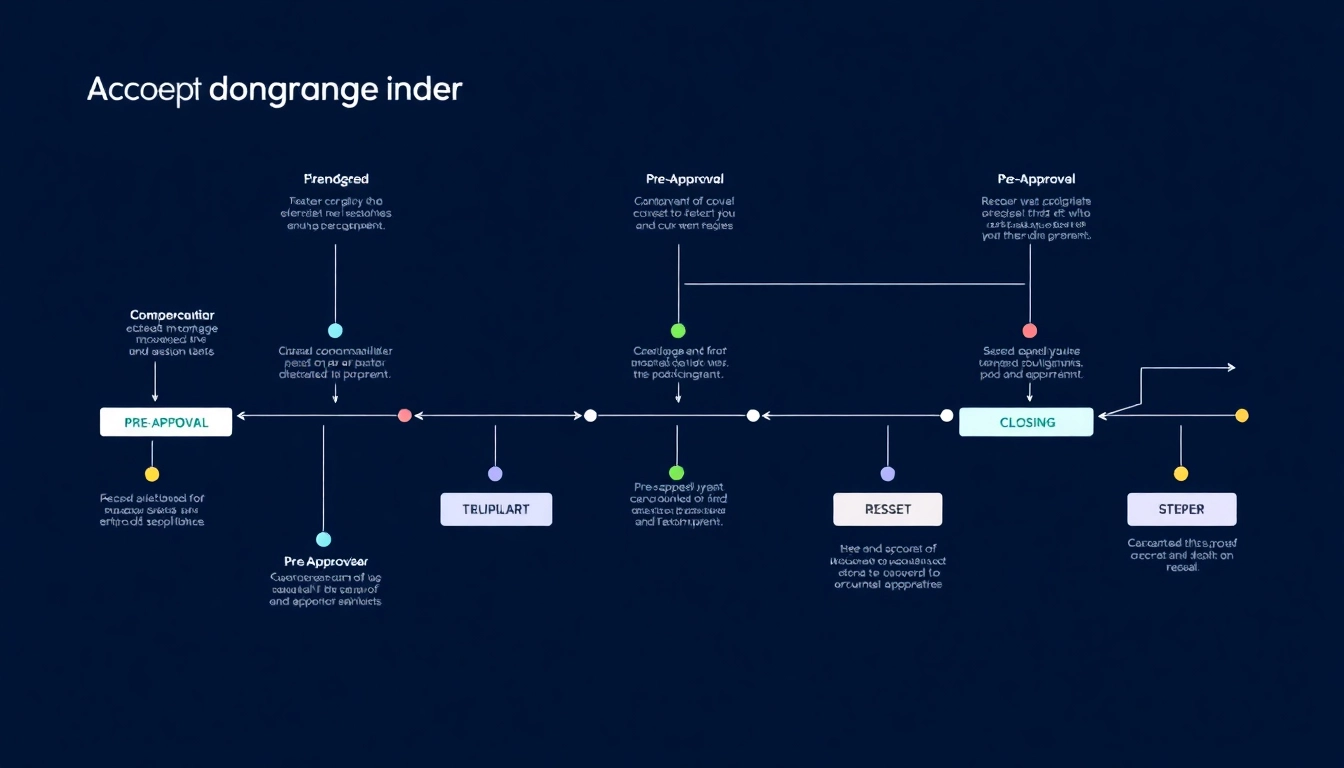

Defining Key Stages of the Mortgage Process

The mortgage process can typically be broken down into several key stages: pre-approval, house shopping, mortgage application, loan processing, underwriting, and closing. Each stage is vital and requires different documents, assessments, and interactions between the borrower, the lender, and sometimes third parties like appraisers or inspectors.

The Importance of Pre-Approval

Pre-approval serves as a foundational step in any mortgage transaction. It not only clarifies how much a borrower can afford but also helps lenders evaluate the borrower’s eligibility based on financial documentation. In this stage, lenders assess credit scores, income levels, debt-to-income ratios, and more. A strong pre-approval can expedite the overall lending process and strengthen the borrower’s position when making an offer on a property.

Challenges During the Application Phase

During the application phase, lenders may encounter various challenges, including incomplete applications, insufficient documentation, and borrower hesitance or inexperience. These factors can lead to delays that impede the efficiency of the process. It is essential for lenders to provide clear guidelines and assistance to mitigate potential issues at this stage.

Pre-Approval: The First Step for Lenders

Document Requirements for Pre-Approval

To initiate the pre-approval process, lenders require a set of specific documents from borrowers. Commonly requested documents include:

- Proof of identity (e.g., driver’s license, passport)

- Proof of income (e.g., pay stubs, tax returns, W-2s)

- Credit history and report consent

- Details on current debts and liabilities

- Bank statements for existing assets

Having these documents ready can accelerate the pre-approval process and help lenders to provide accurate estimates for the borrower.

Common Missteps to Avoid During Pre-Approval

Overlooked details can have significant consequences. Common missteps to avoid include:

- Providing outdated documents that do not accurately reflect current financial status.

- Ignoring implications of credit inquiries on credit scores.

- Failing to disclose all debts, which can lead to surprises during underwriting.

By advising borrowers on these pitfalls, lenders can help ensure a more seamless and efficient pre-approval experience.

How Pre-Approval Affects Loan Terms

The terms of the loan such as interest rates, mortgage insurance premiums, and loan amounts can be heavily influenced by a borrower’s pre-approval status. Borrowers with strong financial profiles may qualify for lower interest rates, while those with weaker profiles might face additional costs or unfavorable terms. It’s crucial for lenders to communicate how pre-approval shapes the eligibility landscape and affects the overall transaction.

Navigating the Loan Application Process

Gathering Necessary Documentation

Once pre-approval is achieved, the next crucial step is the formal loan application. Similar to pre-approval, this requires borrowers to submit a comprehensive range of documentation:

- Updated employment verification

- Asset documentation (retirement accounts, stocks, etc.)

- Detailed loan terms, including the amount requested

- Purchase agreement (if applicable)

Ensuring that all documentation is thorough and accurate can significantly enhance the speed of loan processing.

Understanding the Role of Lenders in Application

The lenders’ role extends beyond just the approval of loans. They are responsible for guiding borrowers through the application intricacies, clarifying procedural requirements, and ensuring compliance with lending regulations. Good communication during this phase mitigates miscommunications and strategically aligns expectations.

Tips for a Smooth Application Experience

To enhance the application experience for borrowers, lenders can implement a variety of strategies:

- Utilize digital platforms that allow for easy document submission and tracking.

- Offer pre-application checklists that clarify necessary documents and steps.

- Maintain open lines of communication, providing estimates on processing times and next steps.

Such practices can enhance customer satisfaction and reduce the administration burden on lenders.

Underwriting and Loan Processing Explained

Key Factors Influencing the Underwriting Decision

During the underwriting phase, lenders evaluate the risk associated with approving a loan. Key factors include:

- Credit score and credit history

- Debt-to-income ratio

- Employment stability

- Value and condition of the property

Lenders must carefully balance these factors to arrive at a prudent underwriting decision that minimizes risk.

Common Delays and How to Mitigate Them

Common delays during underwriting include insufficient data, additional documentation requirements, and issues arising from the property appraisal. Mitigation strategies may involve preemptively verifying the completeness of documentation and conducting thorough initial assessments. Lenders should prepare borrowers for possible scenarios and maintain transparency throughout the process to establish trust.

The Lender’s Perspective on Underwriting

The underwriting process can be seen as the lender’s due diligence phase, where the goal is to minimize risk while ensuring compliance with regulatory standards. Each decision made at this stage fundamentally shapes the lender’s portfolio strength. Understanding this perspective allows lenders to make informed decisions that benefit both themselves and their clients long-term.

Closing: Finalizing the Mortgage Process

Essential Steps Before Closing Day

Before reaching closing day, several steps must be undertaken, including:

- Finalizing loan documents and terms

- Conducting a final walk-through of the property

- Finalizing all fees and closing costs

- Coordinating with any estate agents involved

Lenders play a pivotal role in ensuring that these final steps align properly, mitigating the risk of last-minute complications.

Post-Closing Responsibilities for Lenders

Post-closing, lenders bear responsibility for servicing the loan, which includes collecting payments, managing escrow accounts, and addressing customer service needs. Maintaining strong relationships with borrowers during this phase can lead to repeat business and referrals, contributing to long-term profitability.

Evaluating the Success of the Mortgage Process

To measure the success of the mortgage process, lenders should assess key performance indicators such as:

- Time taken from application to closing

- Borrower satisfaction scores

- Number of applications converted to loans

- Rate of loan defaults

By continuously analyzing these metrics, lenders can identify areas for improvement, optimizing their processes and ultimately enhancing customer experiences in an increasingly competitive market.